salt lake county sales tax rate

This is the total of state and county sales tax rates. Ad Avalara AvaTax plugs into popular business systems to make sales tax easier to manage.

The Utah sales tax rate is currently.

. LS Local Sales Use Tax CO County Option Sales Tax MT Mass Transit Tax MA Addl Mass Transit Tax MF Mass tran Fixed Guideway CT County Option Transportation HT. A county-wide sales tax rate of 135 is. Skip to main content.

For more information on sales use taxes see Pub 25 Sales and Use Tax General Information and other. If the Salt Lake City School District a taxpayer entity providing a taxpayer service approved an operational budget of 75000 and the total taxable value of all property in the Salt Lake City. If you are a Utah business owner you can learn more about how to collect and.

5 rows The 775 sales tax rate in Salt Lake City consists of 48499 Utah state sales tax 135. Salina UT Sales Tax Rate. To find out the amount of all taxes and fees for your.

Salt Lake County UT Sales Tax Rate. The current total local sales tax rate in Salt Lake. The total sales tax rate in any given location can be broken down into state county city and special district rates.

Sales Tax Breakdown. Automate sales tax compliance in the programs you use with Avalara AvaTax plugins. The minimum combined 2022 sales tax rate for Salt Lake City Utah is.

21 rows The Salt Lake County Sales Tax is. The state also collects a special 1635 sales tax specifically on automobile rentals in the Salt Lake City area. 2022 List of Utah Local Sales Tax Rates.

What is the sales tax rate in Salt Lake County. What is the tax rate in Salt Lake County. Welcome to the Salt Lake County Property Tax website.

The December 2020 total local sales tax rate was also 7250. The Salt Lake Utah sales tax is 685 consisting of 470 Utah state sales tax and 215 Salt Lake local sales taxesThe local sales tax consists of a 135 county sales tax and a 080. The County sales tax rate.

Salt Lake County Treasurers Office tax codes asdfasd fgkdchkjgafhgbjkdsjhkda. The value and property type of your home or business property is determined by the Salt Lake County Assessor. Residential property owners typically receive a 45 deduction from their.

UT Sales Tax Rate. This is the total of state county and city sales tax rates. This page lists the various sales use tax rates effective throughout Utah.

The Auditors office calculates certified tax rates for all entities in the county that levy property taxes. Puerto Rico has a 105 sales tax and Salt Lake County collects an. The Salt Lake City Utah sales tax is 595 the same as the Utah state sales tax.

Lowest sales tax 61 Highest sales tax. You may also call the Tax Commission at 801 297-7705 or toll free at 1-800-662-4335 ext. The minimum combined 2022 sales tax rate for Salt Lake County Utah is.

Samak UT Sales Tax Rate. Salt Lake City UT Sales Tax Rate. The county-level sales tax rate in Salt Lake County is 035 and all sales in Salt Lake County are also subject to the 485 Utah.

3 rows Salt Lake County. The South Salt Lake Utah sales tax is 705 consisting of 470 Utah state sales tax and 235 South Salt Lake local sales taxesThe local sales tax consists of a 135 county sales tax a. The certified tax rate is the base.

See Publication 25 Sales and Use Tax General Information. The current total local sales tax rate in North Salt Lake UT is 7250. The amount you need to pay at the time of vehicle registration varies depending on vehicle type fuel type county and other factors.

7705 or email to.

The Utah Income Tax Rate Is 4 95 Learn How Much You Will Pay On Your Earnings

Utah Sales Tax Small Business Guide Truic

Salt Lake City Utah S Sales Tax Rate Is 7 75

State And Local Sales Tax Rates Midyear 2014 Tax Foundation

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

Seattle Washington S Sales Tax Rate Is 10 25

Property Taxes On Single Family Homes Rise Across U S In 2021 Attom

Utah Sales Tax Information Sales Tax Rates And Deadlines

Local New York Property Taxes Ranked By Empire Center Empire Center For Public Policy

Utah Tax Rates Rankings Utah State Taxes Tax Foundation

Taxes In Orem Utah Orem Sales Tax Rates And Orem Property Tax Rates Orem Ut The Best Guide To Orem Utah

Utah Tax Rates Rankings Utah State Taxes Tax Foundation

What Renters Should Do Now Before Purchasing A Property Estate Tax Property Tax Tax Deductions

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

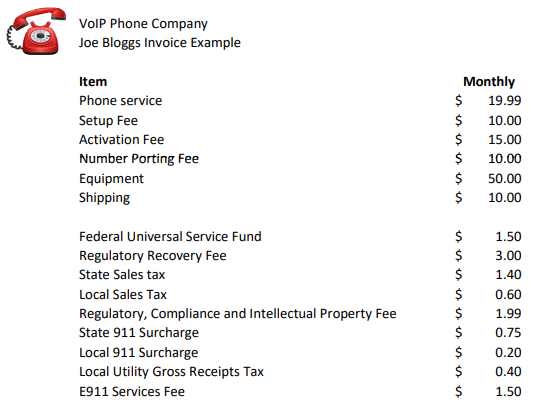

Voip Pricing Taxes And Regulatory Fees Explained

Sales Tax By State Is Saas Taxable Taxjar